Homeowner Digests

Welcome! Homebot is here to make sure your home purchase is a financially wise decision and that you get the most out of your loan options.

Introduction

Homebot is a marketing and educational platform for homeowners. Data comes from various real estate sources and from your lender. This guide breaks down each module and explains any questions or concerns you may have.

There are always ways to improve your home loan situation. The more you know about your living situation, like how long you will stay in your house, the more you can make better financial choices. Using a mortgage correctly can improve your lifestyle during retirement years and financially protect you and your family along the way. The end goal is to make more financially secure and knowledgeable decisions.

Have you checked your loans? It is important to review your mortgage every year. Crazy, right? Every year! If you think about it there are a lot of things that change from year to year:

- Home Value

- Life Circumstances (lose a job, join a startup, have health issues)

- Principal Paid

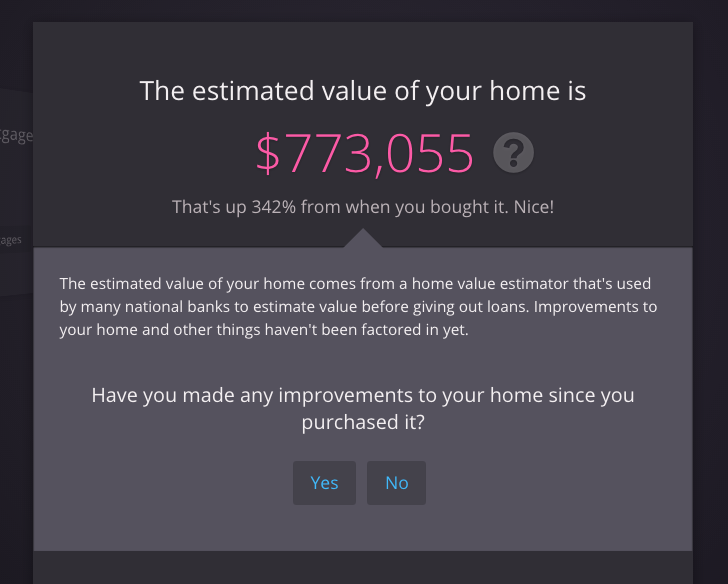

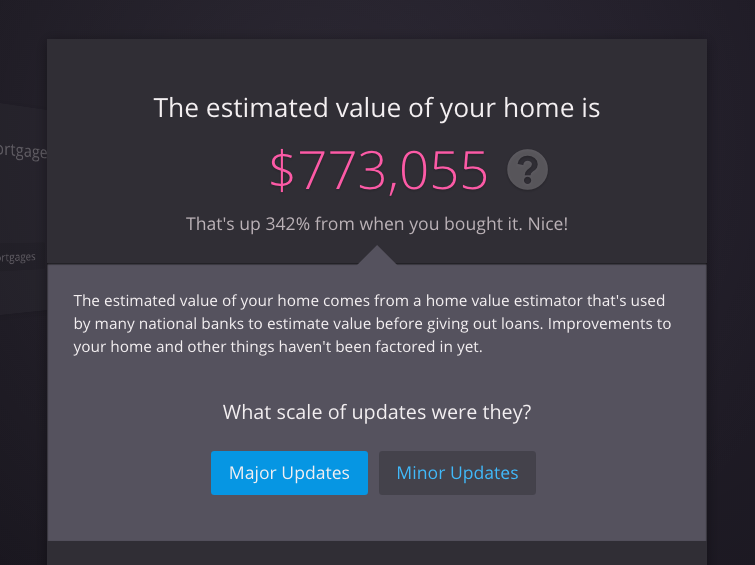

- Home Improvements

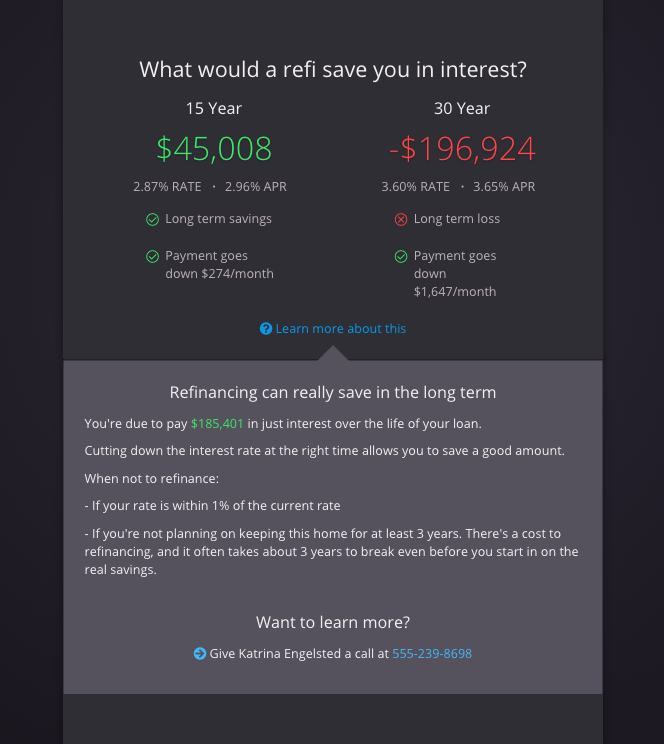

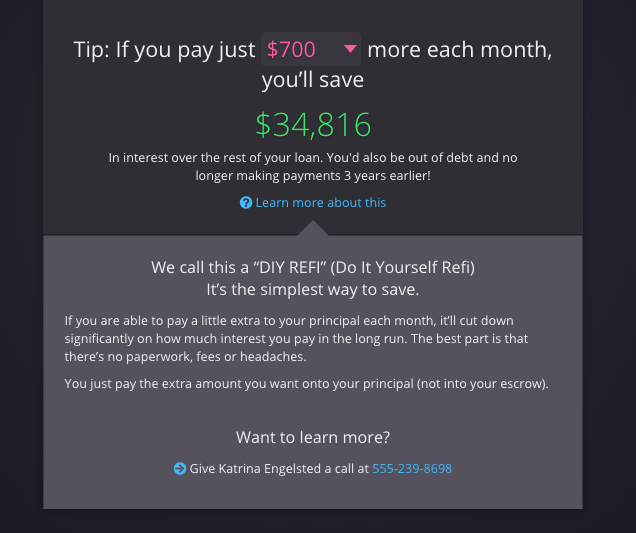

Reviewing your loans annually can help you determine when a good time to refinance would be as well. There are several advantages to refinancing, including:

- lowering your interest costs over the life of the loan

- freeing up cash to pay off consumer debt

- tax advantages

- lowering your total monthly payments

- converting an adjustable rate mortgage to a fixed in order to reduce payments and interest

- rate risk

Homebot will help you gain intelligence throughout the year. In the meantime, the fastest way to get an answer is to call your lender today to see if you qualify for better programs or loans that might not have been available previously. Also, while you are reviewing your loan it does not hurt to check your credit score and help prevent identity theft... but we can get into that later.

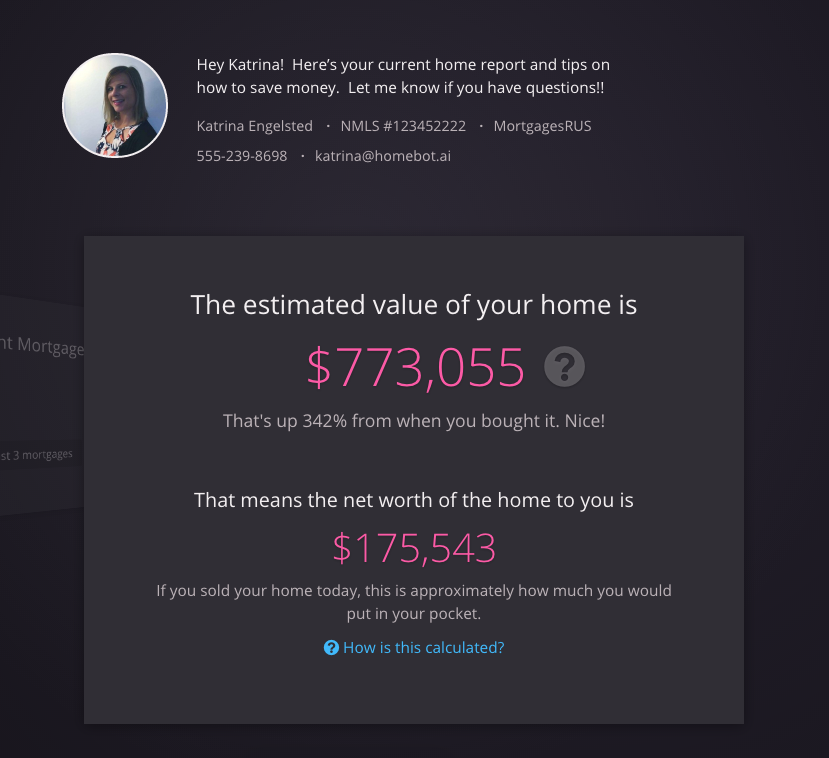

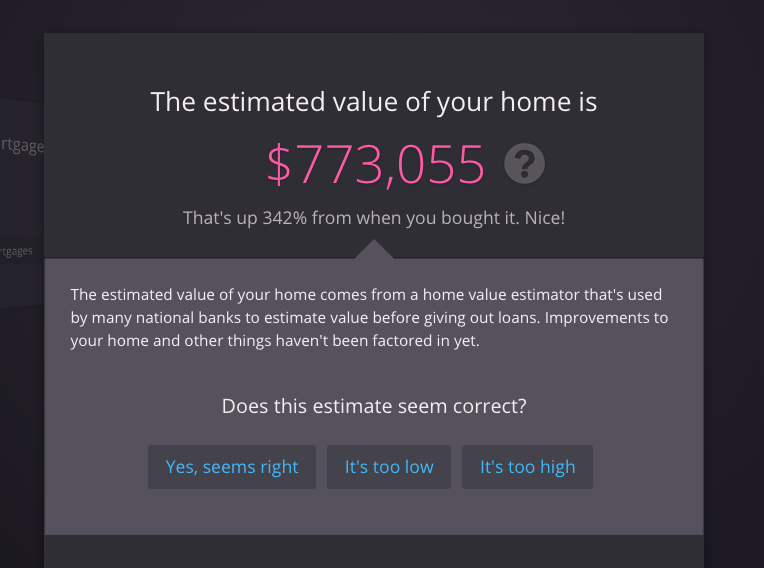

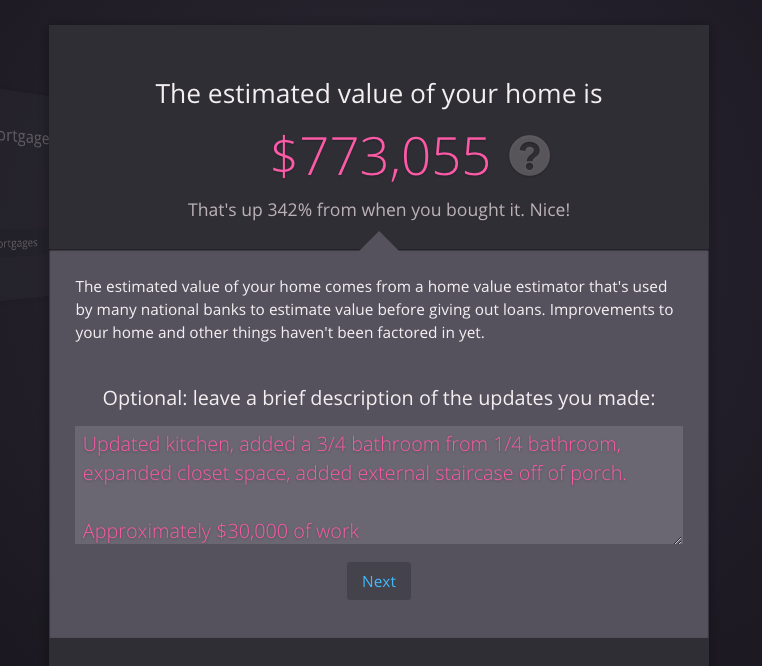

Home Value/Net Worth module

Challenge value of Home (CMAs)

Interest module

Rental module

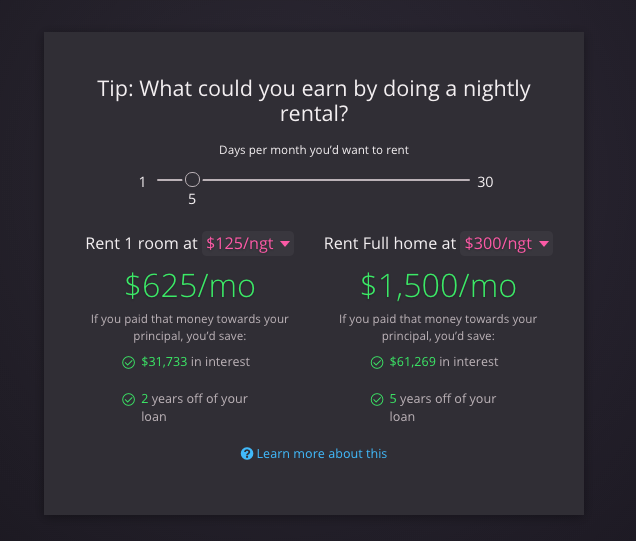

This module is an estimate for ways that homeowners could make a little but more income. Two nights a month can allow homeowners to add $200 a month to paying off loan principle.

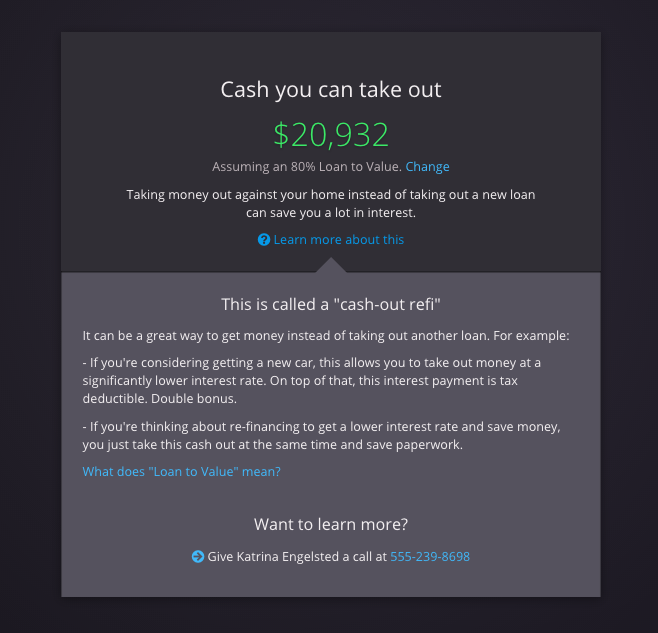

Cash Out Refinance module

Frequently Asked Questions

Who is paying for this free advice?

A majority of the lending industry is commission based. Lenders receive pay from closing costs, reselling the loans, and/or additives on mortgage. Therefore, closing loans, refinances and HELOCs correlate to more income.

Where does this data come from? Who knows all of this private information?

Data on homeowners profiles come from two main sources: your lender and/or automated valuation models from reputable data sources.